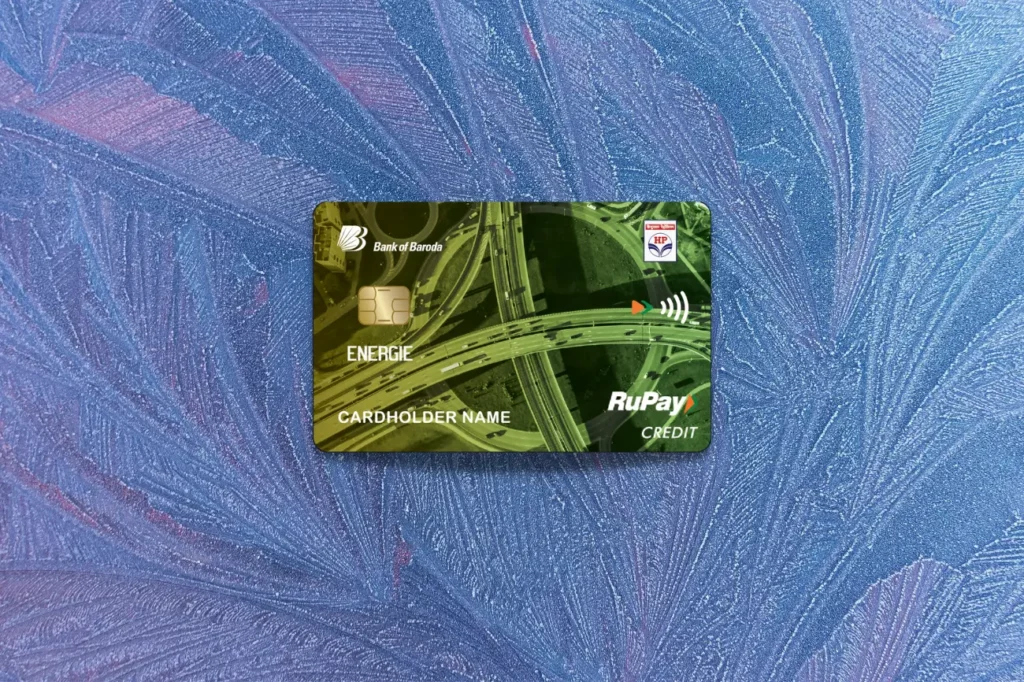

The Bank of Baroda has partnered with HPCL to introduce the HPCL Bank of Baroda ENERGIE Credit Card, a new entrant in the co-branded fuel card market.

This card targets customers who frequently spend on fuel, promising to turn routine transactions at HPCL fuel stations into rewarding experiences.

With the rising cost of fuel, a credit card that offers savings and benefits on fuel purchases can be a valuable asset for vehicle owners.

The credit card comes with an array of features designed to offer savings on fuel expenditures. Cardholders can earn reward points on their spending, particularly when purchasing fuel at HPCL stations.

Moreover, the card extends its utility by providing benefits that stretch beyond just fuel rewards, encompassing a series of perks well-suited for daily use.

The HPCL Bank of Baroda ENERGIE Credit Card also positions itself competitively among other fuel cards by offering a simple fee structure.

With a modest joining and annual renewal fee, the card is accessible to a broad range of customers.

Additionally, the rewards earned on fuel spends can be redeemed without incurring additional charges, enhancing the overall appeal of the card in comparison to its counterparts that may levy fees for redemption.

Card Highlights

| Card Category | Fuel |

| Card Issuer | Bank Of Baroda |

| Credit Card Network | Rupay |

| Reward Multiplier | Yes |

| Welcome Reward | No |

| Annual Fees | ₹500 |

| Airport Lounge Access | 4 complimentary airport lounge visits per year |

| Recommended Credit Score | 700+ |

| CG Ratings | 4.2/5 |

Table of Contents

Key Benefits of BOB HPCL Energie Credit Card

The BOB HPCL Energie Credit Card offers a range of benefits tailored for savings on fuel and additional rewards across various categories. Here’s a breakdown of the key advantages cardholders can enjoy:

Welcome Benefits

New cardholders are rewarded with 2000 bonus reward points after spending ₹5,000 within the first 60 days of card issuance, which aids in offsetting the annual fee.

Fuel Benefits

- Savings on Fuel: Cardholders can save up to 5% on fuel purchases at HPCL retail outlets, with 24 Reward Points per ₹150 spent, amounting to a 4% saving, plus a 1% Fuel Surcharge Waiver on the same transactions.

- HP Pay App Cashback: An additional benefit of 1.5% cashback in payback points is available when fuel purchases are made through the HP Pay App, applicable up to a limit of ₹6250 in fuel spends.

Reward System

- Grocery and Departmental Stores: A robust reward system allows for 5X reward points, equivalent to 10 points for every ₹150 spent in these categories, with a cap of 1000 Reward Points each per statement.

- General Spends: All other transactions accrue 2 Reward Points for every ₹150 spent.

Movie Benefits

- Discounts on Movies: A 25% discount up to ₹100 is available for a minimum of 2 movie tickets per transaction when booked via Paytm Movies up to twice a month for each primary cardholder.

Airport Lounge Access

- Complimentary Access: Cardholders are entitled to 4 complimentary airport lounge visits per year, enhancing the travel experience.

Fuel Surcharge Waiver

- Monthly Waiver: A 1% fuel surcharge waiver is applicable, with a maximum benefit of ₹100 per month.

Fees and Charges

When considering the HPCL Bank of Baroda ENERGIE Credit Card, potential cardholders should be aware of the various fees and charges associated with the card.

These include one-time joining fees, recurring annual fees, costs for cash advances, interest rates on outstanding balances, and charges applicable on foreign currency transactions.

Joining and Annual Fees

- Joining Fee: Rs. 499 + GST

- Annual Fee: Rs. 499 + GST

- Fee Waiver: Cardholders can have the annual fee waived if they spend ₹50,000 or more in every anniversary year.

Cash Advance Fees

- The bank charges the higher of 2.5% of the transaction amount or Rs. 500 for cash advances.

Interest Rate

- The interest rate charged on outstanding balances is set at 3.49% per month (which is 41.88% on an annual basis).

Forex Markup

- Foreign currency transactions incur a markup fee of 3.5% plus applicable GST.

Eligibility and Application Process

To apply for the Bank of Baroda HPCL ENERGIE Credit Card, applicants must meet certain eligibility criteria.

They must be residents of India and fall within the age bracket of 21 to 65 years for the primary cardholder. Add-on cardholders must be at least 18 years old. Salaried applicants require a minimum annual income of ₹3.6 lakhs, while self-employed individuals must show an income of at least ₹4.8 lakhs.

Documents Required:

- Identity Proof: A photocopy of the PAN card is necessary.

- Income Proof: Bank statements showcasing the latest salary credits for salaried employees or the current financial year’s Income Tax Return for self-employed applicants are required.

- Residence Proof: Documents to confirm the current residential address.

- Photograph: One recent passport-size photograph should be provided.

Application Process:

Prospective cardholders can apply for the credit card through a 100% digital application process, which includes filling out an electronic form, e-signing the application, and completing a Video-KYC (Know Your Customer) procedure.

This streamlined process ensures a quick and efficient application experience.

What is the Value of Reward Voints in BOB HPCL Energie Credit Card?

The value of reward points on the Bank of Baroda HPCL Energie credit card is a direct translation of points accrued to monetary value.

When cardholders spend using this credit card, they collect reward points that can be redeemed later.

For the Bank of Baroda HPCL Energie credit card, each reward point is worth ₹0.25.

To illustrate:

- Fuel Transactions: For every ₹150 spent on fuel transactions at HPCL outlets, cardholders earn 24 reward points. This translates to a reward value of ₹6 (24 points x ₹0.25 per point).

- Other Categories: When cardholders use the card for groceries and departmental store purchases, they accumulate 10 reward points for every ₹150 spent, which equals a reward value of ₹2.5 (10 points x ₹0.25 per point).

It’s also crucial to note that reward redemption does not invite additional charges, making it a seamless experience for cardholders to utilize their points.

These reward points represent tangible savings and additional value back to the cardholder for expenses they would incur regardless.

The strategic utilization of the HPCL Energie credit card, especially for fuel purchases at HPCL outlets can substantially enhance the value derived from reward points.

Comparative Analysis

This section provides a detailed comparative analysis, focusing on how the Bank of Baroda HPCL ENERGIE Credit Card stands against competitors and its market positioning.

Competitor Comparison

The Bank of Baroda HPCL ENERGIE Credit Card is designed with a structure that outscores other fuel cards in the market.

Offering benefits such as RuPay lounge access and the widespread availability of HP fuel stations, it is positioned favorably against offerings like the Union Bank Carbon Credit Card and Citi Bank Indian Oil Credit Card.

A comparison table for clarity:

| Feature | BoB HPCL ENERGIE Card | Union Bank Carbon Card | Citi Indian Oil Card |

|---|---|---|---|

| Lounge Access | 4 domestic Visits | Not Offered | Not Offered |

| Fuel Station Network | HPCL Stations Nationally | Limited | Indian Oil Stations |

| Reward Structure | Generous Rewards Rate | Standard Rewards | Standard Rewards |

The card’s reward structure is another aspect where it excels, presenting users with more value per transaction, especially in comparison to similarly purposed credit cards.

Market Positioning

In terms of market positioning, the HPCL Bank of Baroda ENERGIE Credit Card leverages a strategic alliance with Hindustan Petroleum to offer significant savings, marketed to exceed ₹12,000 annually for the typical user.

This advantage is highlighted in its marketing and defines its standing in the segment of fuel credit cards.

The card’s value proposition is strengthened with features designed for everyday use, promoting it as not just a fuel card, but a lifestyle accompaniment.

The inclusion of discounts on movie tickets and dining experiences contribute to its comprehensive approach, elevating its appeal and positioning in the market.

Bottom Line

The HPCL Bank of Baroda ENERGIE Credit Card is tailored for those who frequently spend on fuel, with a clear focus on savings at HPCL pumps.

Cardholders can expect to glean a series of rewards specific to fuel purchases, potentially offsetting annual costs by way of savings on fuel expenses.

Key Considerations:

- Fuel Benefits: The card is most beneficial when used at HPCL pumps.

- Annual Savings: Cardholders may save more than ₹12,000 annually, depending on their fuel consumption.

Usage Outside Fuel Purchases:

The rewards rate drops significantly for non-fuel categories, signaling that the card’s primary advantage lies within the confines of HPCL fuel stations.

Reward Redemption:

The card allows for straightforward redemption of reward points, equating to a value of Rs. 0.25 per point, without imposing redemption charges. This feature is notably advantageous compared to other cards that charge for cash redemptions.

In summary, the HPCL Bank of Baroda ENERGIE Credit Card is positioned to provide utility to fuel-focused consumers, seeking to maximize returns on their fuel expenditure while offering modest rewards on general spending.

It is pertinent for consumers to evaluate their spending patterns against the card’s reward structure to gauge its overall value for their personal use.